how to calculate tax withholding for employee

The IRS provides a taxpayer guide for filling out your Form. Change Your Withholding To change your tax withholding use the results from the Withholding Estimator to determine if you should.

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

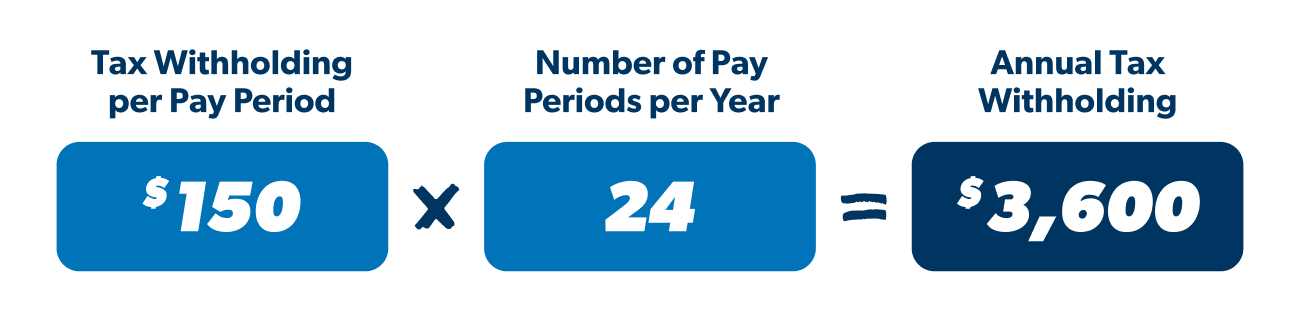

For example each period you withhold 200 and receive payments twice a month.

. How to calculate withholding tax. The amount you earn. How to Calculate and Adjust Your Tax Withholding.

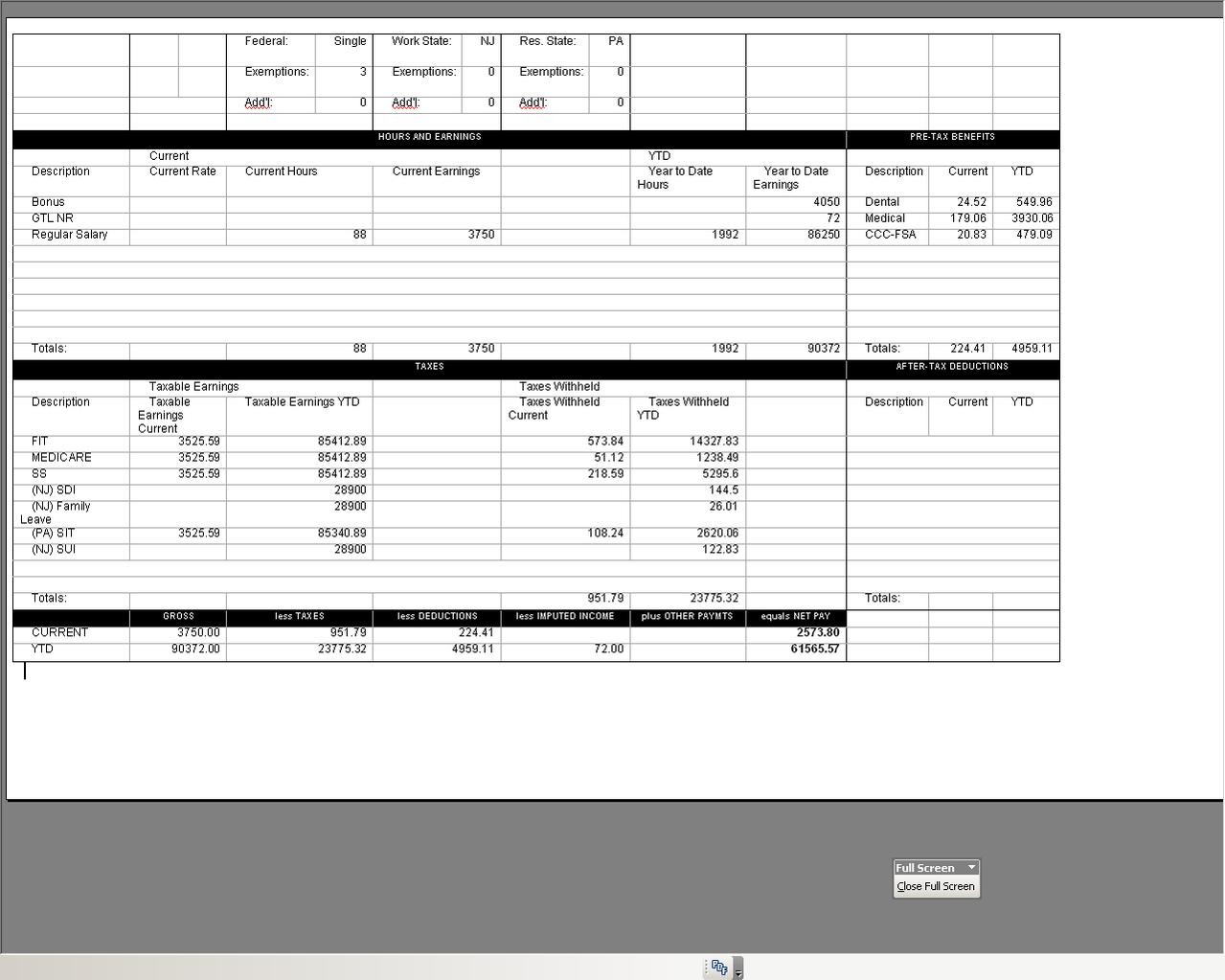

Withholding tax is the amount held from an employees wages and paid directly to the state by the employer. Study your employees Form W-4. This is another reason an employee may want to re-calculate their withholding tax in the middle of a tax year.

You can do this by completing Step 1 on. Ready to get your tax withholding back on track. 9 Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

To calculate the amount of Social Security andor Medicare withheld from your paycheck calculate your Taxable Gross. WA Medical Aid Fund. To calculate the amount of Medical Aid withheld from your paycheck multiply the number of hours worked by the following rates.

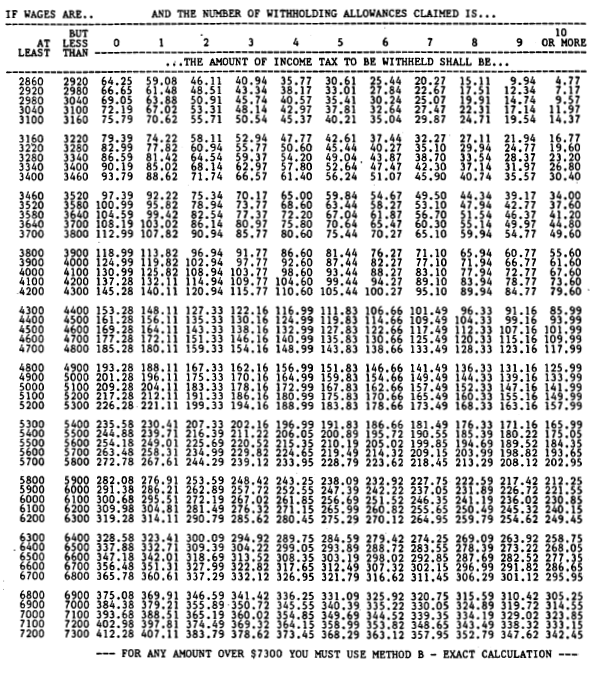

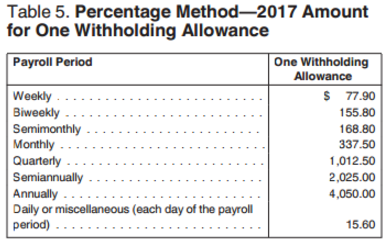

Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter. WASHINGTON The Internal Revenue Service said today that the new Tax Withholding Estimator tool includes a feature designed to make it easier for employees who. To calculate tax withholding amount employers determine the number of allowances employees claim on their IRS Form W-4 Employees Withholding Allowance.

Total Up Your Tax Withholding. How withholding is determined The amount withheld depends on. After youve determined that you can use.

This includes tax withheld from. The amount of income earned and Three types of information an employee gives to their employer on Form. The first step in.

Save a copy of the spreadsheet with the employees name in the file name. The information you give your employer on Form. Complete a new Form W-4 Employees.

Withholding tax is income tax withheld from employees wages and paid directly to the government by the employer and the amount withheld is a credit against the income taxes. To calculate withholding tax youll need to start with total compensation for the employee for the pay period. Heres the good news.

Each pay period open each. What You Need Have this. Gross Pay minus any Pre-TaxReductions for Social.

The calculation for FICA withholding is fairly straightforward. To use the new federal withholding tax table that corresponds with the new Form W-4 first find the employees adjusted wage amount. When we already know the monthly withholdings it is easy to calculate the annual amount.

Enter the requested information from your employees Form W-4. To calculate your employees withholding tax well go through a number of simple but important steps below. The amount of income tax your employer withholds from your regular pay depends on two things.

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

How To Calculate Payroll Taxes For Your Small Business

What Is Form W 4 What Do I Do As An Employer Updated For 2019 Gusto

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

What To Do When Employee Withholding Is Incorrect

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

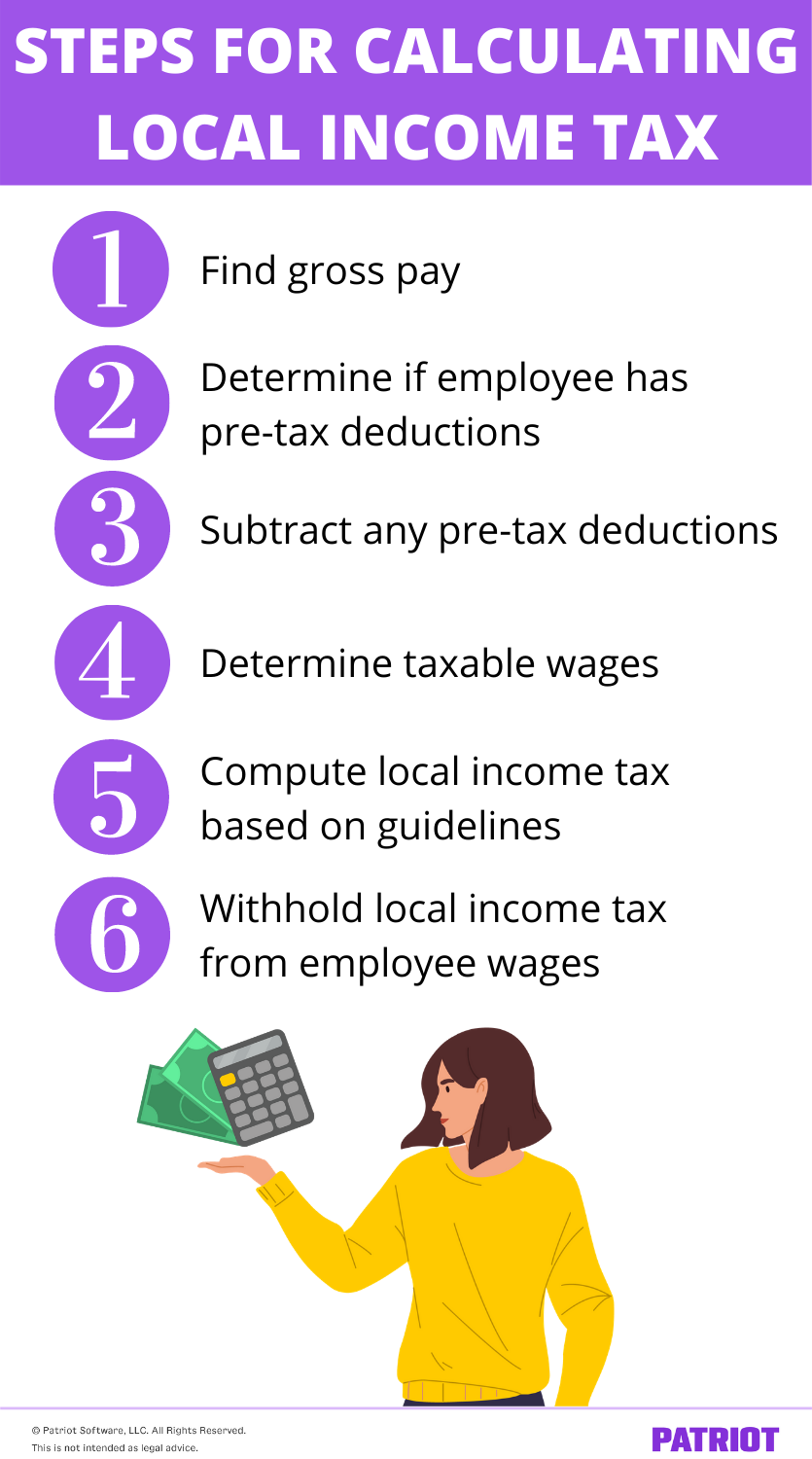

How To Calculate Local Income Tax Steps More

Payroll Tax What It Is How To Calculate It Bench Accounting

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How Are Payroll Taxes Calculated Federal Income Tax Withholding Payroll Services

Understanding Your W 4 Mission Money

How To Calculate Your Tax Withholding Ramsey

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Calculate Payroll Taxes In 5 Steps

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

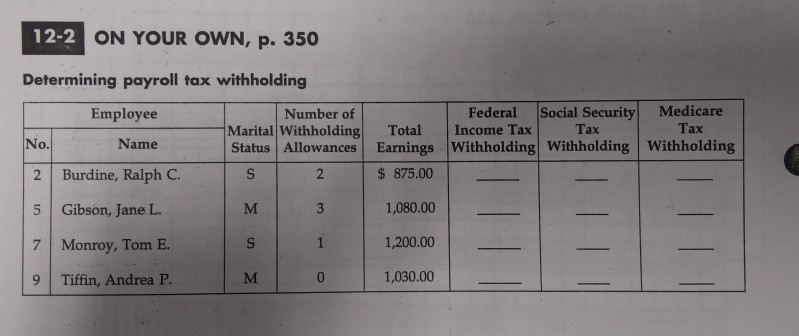

Solved 12 2 On Your Own P 350 Determining Payroll Tax Chegg Com

Payroll Taxes Paid By Employer Overview Of Employer Liabilities